Australia's Highest Paying Gold Buyers $$$

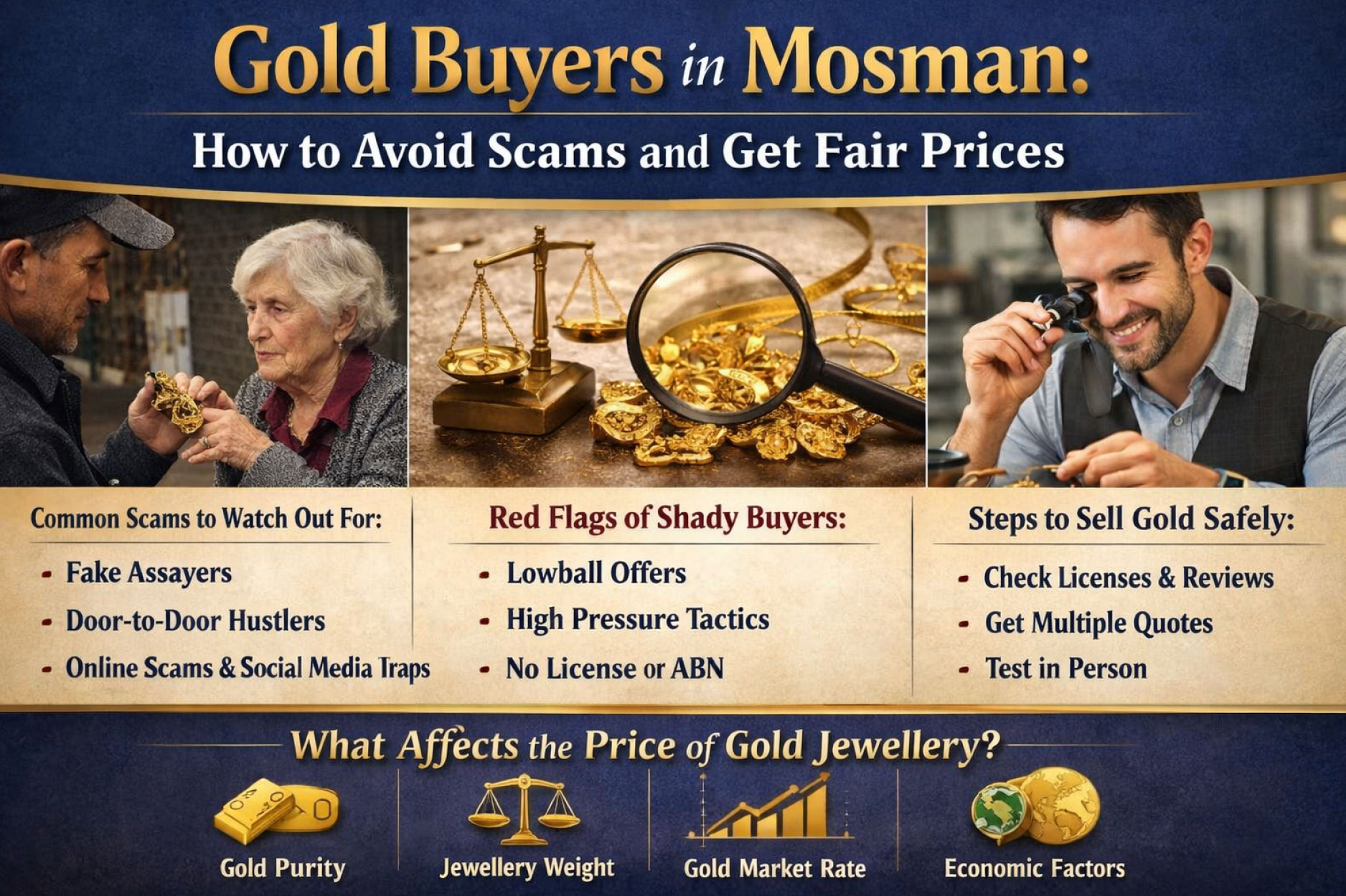

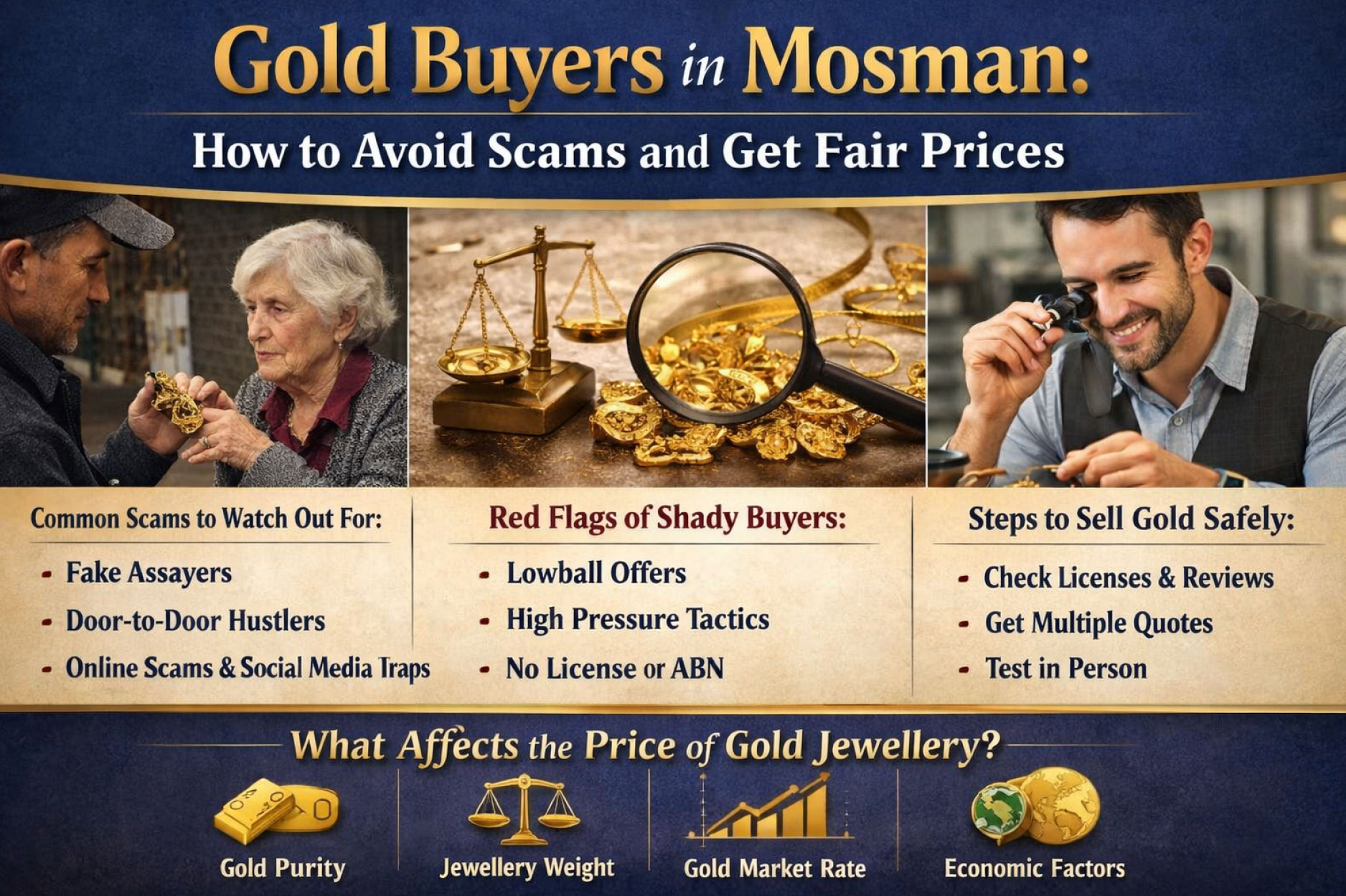

Gold Buyers in Mosman: How to Avoid Scams and Get Fair Prices

Selling your gold in Mosman may seem simple — but if you choose the wrong buyer, you could lose a large amount of money. In recent years, Australians have faced increasing losses from fraudulent buyers and unclear pricing, especially when gold prices spike. According to scam reporting services, scams involving buying and selling online or in person are common and often rely on fake credentials or misleading offers.

This guide walks you through the common scams, warning signs, and smart steps to pick a trustworthy buyer in Mosman so you sell your gold safely and get fair prices.

Common Gold Buying Scams in Mosman

Fake Assayers Who Underpay

Some scam operations pose as professional shops but don’t offer real testing. They claim to test your jewellery for purity, but the results are incorrect, and you get paid far below market value. Many scam sites even copy logos and business details from real buyers to seem legitimate — so always verify business details before selling.

Door-to-Door Hustlers

While not strictly limited to gold, scammers sometimes come to your doorstep with unsolicited offers or flyers, claiming they buy gold on the spot. These buyers often lack official licenses and provide no paperwork. If someone shows up unannounced, it’s a strong red flag.

Online Buyer Traps

Scammers create professional-looking websites and social media listings to lure sellers. They may request you send your gold by post, promise a high payout, then disappear. Always check that an online buyer has a valid Australian business registration and a real physical address before selling anything.

Social Media Marketplace Scams

Marketplaces and classified ads can be breeding grounds for scam listings. Profiles with no reviews, non-traceable contact details, or pressure to complete the deal quickly should be treated with caution.

Red Flags of Shady Gold Buyers

Pricing Tricks That Confuse Sellers

Many scammers offer confusing or unusually high rates to bait sellers. Real gold buyers calculate offers based on the spot price of gold, subtracting reasonable fees. Gold scrap value calculators show that the price you receive depends on the weight and purity of your item, and reputable buyers usually pay a percentage close to the market value.

Pressure Tactics

If a buyer says “this offer expires today” or pushes you to sell immediately without time to think, this is a classic pressure tactic. Scamwatch warns that urgency and unsolicited contact are top warning signs of a scam.

Unprofessional Setup

A gold buyer with no visible scales, no paperwork, or trading out of a van or private address is risky. Legitimate buyers operate from established locations and provide receipts with clear terms.

No Licensing or Credentials

In Australia, reputable buyers will have registered business details, licensing, and clear contact information. If a buyer cannot show an ABN or verified registration, walk away.

Steps to Pick a Trustworthy Buyer in Mosman

Check Licenses, ABN, and Reviews

Start by checking the buyer’s Australian Business Number (ABN) and reviews from local sellers. Reviews on Google, Facebook, or Yelp provide insights into others’ experiences.

Visit the Store & Observe

Always visit the buyer in person at their physical location. A legitimate buyer will test your gold in front of you using proper equipment and explain how the offer is calculated.

Ask for a Written Quote First

Trustworthy buyers will provide a written quote detailing weight, purity, and pricing. This protects you and allows you to compare offers.

Get Multiple Quotes

Comparing multiple offers helps you understand fair market value. Many experienced sellers report significantly better payouts when shopping around rather than accepting the first offer.

Why Understanding Pricing Matters Before You Sell

Before you sell your gold jewellery, it’s important to understand what affects its price. This not only helps you get a better deal but also protects you from lowball offers.

Gold Purity (Karat)

The purity of gold directly affects value. Pure gold (24K) is more valuable, while lower karat jewellery contains less gold and is worth less by weight. For example, 22K gold is around 91.6% pure, while 18K is 75% pure — this difference changes the value by grams.

Weight of the Jewellery

Gold is priced per gram — the heavier your item, the more it’s worth. When selling, only the gold metal weight counts, not stones or decorative elements.

Current Gold Market Price

Gold prices fluctuate daily based on global markets. Dealers calculate payout using the live gold rate — a higher spot price typically means higher payout for sellers, and vice versa.

Craftsmanship & Design

While raw gold value depends on weight and purity, jewellery that is highly detailed or handcrafted may have additional retail value — though most gold buyers focus primarily on metal value, not design.

Economic Conditions & Demand

Global factors like inflation, currency strength, and economic uncertainty influence gold prices. In uncertain times, gold often becomes more valuable as investors seek safe assets, which can indirectly affect what buyers offer.

You can learn more about the factors affecting the price of gold jewellery, and how this impacts payouts when you Sell Gold in Australia.

Local Mosman Resources and Seller Protections

Trusted Buyers in Mosman

Look for established shops with years of operation and strong community reviews. Talk to locals or check business listings to find reputable buyers.

Where to Report Scams

If you suspect a scam, report it quickly to NSW Fair Trading or Scamwatch. Early reporting increases chances of recovery and helps authorities track repeat offenders.

Gather Evidence

Keep any texts, emails, quotes, and receipts as proof when reporting. This documentation is useful for police reports or if you seek chargebacks through your bank.

Conclusion

Selling gold in Mosman doesn’t have to be risky if you follow the right steps. Always:

Verify buyer credentials

Ask for written quotes

Compare multiple offers

Watch for pressure tactics

Understand pricing factors

Being informed helps you avoid scams and get the fair price your gold truly deserves. Stay smart, verify before you sell, and make the most out of your gold in 2026 and beyond!

Written By

Team Times&Gold

Journal Insights

Visit Us in Parramatta!

NO APPOINTMENTS NEEDED!

Located inside DLUX Jewellers

Opposite Commonwealth Bank